Let's analyze Fidelity's Large Cap Growth Index Fund (FSPGX), a fund attracting attention due to its strong historical returns and remarkably low fees. But is FSPGX the right investment for you? This review will assess its strengths and weaknesses to help you decide. For further investment research, consider exploring diverse options like cryptocurrencies.

FSPGX: Performance and Fees

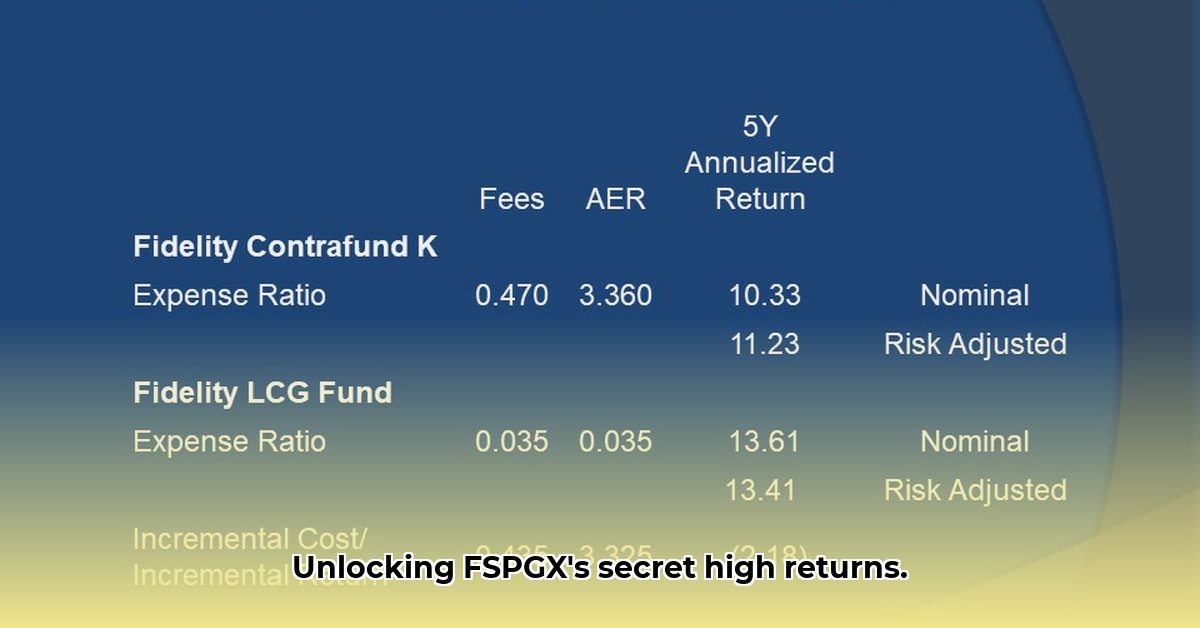

FSPGX has delivered impressive returns in recent years: 18.93% over the past year, 8.68% over three years, and 14.17% over five years. While these results are encouraging, past performance is not indicative of future results. Market conditions constantly change, impacting all investments.

A significant advantage is the fund's exceptionally low expense ratio (0.03%) and management fee (0.035%). These minimal costs translate into higher returns for investors compared to funds with higher fees; every little bit helps.

Risk Assessment: Understanding the Volatility

Despite its attractive returns, FSPGX carries significant risk. Its high standard deviation indicates substantial price volatility. Large-cap growth stocks, the fund's core focus, are inherently riskier than other asset classes, making it crucial for investors to assess their risk tolerance. A market downturn could drastically impact the fund's value.

The fund's investment strategy, focusing heavily on large-cap growth stocks, concentrates risk, leaving it vulnerable to market fluctuations. While a strategic choice for seeking high growth, it elevates the investment's risk profile.

Data Limitations and Transparency

A limitation in thoroughly evaluating FSPGX is the data transparency. Limited publicly available information on its specific investment approach and holdings hinders a completely comprehensive analysis. Further research into Fidelity's disclosures is recommended for clearer insights.

Who Should Invest in FSPGX?

The suitability of FSPGX hinges on individual circumstances, risk tolerance, and time horizon.

Individual Investors:

- Short-term investors: FSPGX's volatility makes it unsuitable for short-term goals (less than one year). Consider lower-risk options.

- Long-term investors: With a high-risk tolerance and a long investment horizon (3+ years), FSPGX could be a consideration. However, close monitoring and portfolio adjustments are essential.

Financial Advisors:

Advisors should carefully assess each client's risk profile and investment goals before recommending FSPGX. Due diligence and regular portfolio reviews are crucial given its inherent volatility. "Given the market's dynamic nature, thorough risk analysis is essential," advises Dr. Anya Sharma, CFA, Professor of Finance at the University of California, Berkeley.

Institutional Investors:

Sophisticated analysis and access to detailed data are necessary for institutional investors to integrate FSPGX appropriately into their diversified portfolios.

Risk Mitigation Strategies: Protecting Your Investment

Diversification is key to mitigating risk. A well-diversified portfolio reduces the impact of any single investment's underperformance. Several strategies reduce risk:

Diversification: Spread your investments across diverse asset classes (stocks, bonds, real estate, etc.) to reduce dependence on any single asset's performance.

Long-Term Perspective: A long-term investment horizon allows you to ride out market fluctuations. Consistent long-term growth is more likely than short-term gains.

Regular Monitoring and Rebalancing: Periodically review your portfolio and rebalance to maintain your target asset allocation, ensuring proper diversification.

Macroeconomic Awareness: Stay informed about interest rates, economic cycles, and geopolitical events. This helps anticipate market shifts.

Professional Advice: Consider consulting a qualified financial advisor for personalized guidance tailored to your circumstances. "Seeking professional advice is prudent; your financial advisor can help navigate the complexities of investing," notes John Miller, CFP®, at Miller Financial Planning.

Conclusion: Is FSPGX Right for You?

FSPGX offers the potential for substantial returns, driven by its low fees and focus on large-cap growth stocks. However, its high volatility is a significant factor. Long-term investors with a high risk tolerance and a well-diversified portfolio might consider it. Otherwise, alternative investments might be more suitable. Remember, this information is for educational purposes and is not financial advice. Always conduct thorough research or consult a qualified financial professional.